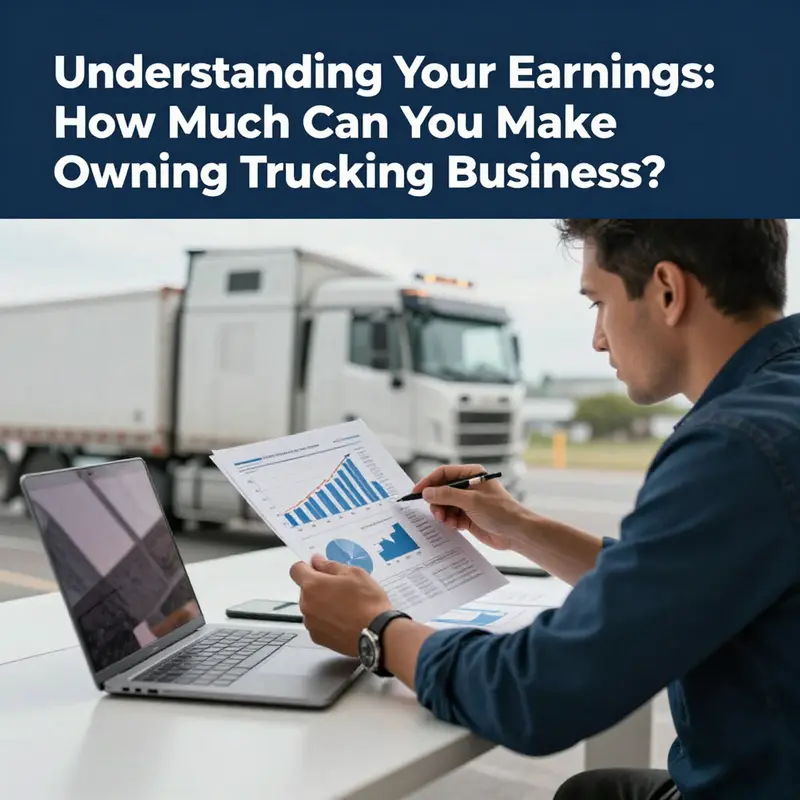

Understanding the income potential of your trucking business is crucial for strategic planning and operational success. This article delves into how much you can realistically earn by owning a trucking business, taking into account the complexities of revenue generation and various operational costs. Each chapter builds on key aspects such as revenue potential, operational expenditures, influencing profit margins, the impact of market demand and geographic regions, and real success stories that exemplify earning capabilities in this sector. By exploring these insights, you will gain a comprehensive view of the trucking industry’s financial landscape, paving the way for informed decision-making and strategic growth.

Earnings Unpacked: Real Revenue Paths and Profit Drivers for Trucking Business Owners

Understanding where the money comes from — and where it goes — is the most reliable way to forecast earnings in a trucking business. Revenue is not a single number you can latch onto. It is the result of choices about equipment, services, markets, and how carefully you manage costs. For owner-operators and small fleets, particularly in regions with active raw-forest-product flows, gross revenue can range widely. Practical benchmarks show successful operators generating between $150,000 and over $300,000 in annual gross revenue per truck, but net profit narrows that picture. Independent owners in high-demand Southern markets often land between $40,000 and $80,000 in net income, with top performers exceeding $100,000. Those ranges are useful only when you unpack the components that create them.

Revenue sources in trucking are more diverse than most outsiders assume. The core remains hauling freight, and rates will vary by cargo type, distance, and season. Dry vans, refrigerated loads, flatbeds, and industry-specific work like forest products each carry different rate structures and utilization patterns. Beyond hauling, many owners add adjacent income streams. One of the most effective is acting as a freight intermediary. By arranging loads between shippers and carriers, owner-operators can earn steady commission income that supplements driving revenue. Brokerage activity can generate an additional $1,000 to $3,000 monthly for a focused owner, depending on volume and contract terms. That extra income not only pads the bottom line; it smooths cash flow when haul opportunities ebb.

Investing in higher-efficiency trucks is another lever for income improvement. Newer medium and heavy-duty vehicles deliver measurable fuel economy and lower maintenance needs. The upfront cost can be significant, and the decision is normally driven by simple business math, not trend appeal. When fuel is a major budget line, even small percentage improvements compound quickly over a year of highway miles. For a single truck, improved fuel economy might save thousands annually. For small fleets, the savings scale and improve overall margin. However, narrow profit margins mean adoption of advanced vehicle technology must be carefully modeled. Financing terms, expected uptime, and residual values matter. Without a clear payback timeline, the investment can undermine short-term cash flow, even if it looks attractive on a five-year pro forma.

Costs determine how gross revenue translates to owner income. Expected monthly truck payments range from about $1,500 to $3,000 for financed or leased equipment. Fuel is the largest variable expense and directly affects profitability. Maintenance and unexpected repairs are predictable only in aggregate; a preventive maintenance program reduces risk but increases fixed costs. Insurance and permits add substantial regular expense lines. Safety and compliance also create administrative costs. Hours-of-service and electronic logging rules protect drivers but introduce scheduling constraints that may lower utilization. Add driver wages or your own compensation and the margin picture becomes clearer. Conservatively, total operating costs for an owner-operator can consume the majority of gross revenue, leaving the margins reflected in the net income figures above.

Operational choices have outsized impact. Minimizing empty miles, securing consistent backhauls, and locking in long-term contracts can transform a mediocre year into a profitable one. Dedicated routes with predictable volumes reduce marketing time and lower the risk of underutilized assets. Using load boards and freight brokerage relationships fills gaps. Investing in route planning and telematics improves utilization, while disciplined maintenance reduces downtime and repair spikes. Many successful operators combine these tactics: they run profitable lanes, broker overflow freight, and strategically invest in efficiency improvements. Human capital is part of the equation. Investing in recruitment, training, and retention reduces turnover and keeps trucks moving. For a deeper look at managing fleets through people-first strategies, see this discussion on transforming fleet management through investing in human capital: https://titanbusinesstrucks.com/transforming-fleet-management-the-case-for-investing-in-human-capital/

Region and market matter. Southern U.S. corridors with heavy raw-forest-product traffic offer high-volume opportunities, but they also have specialized handling requirements and seasonality. Coastal and intermodal markets may pay differently. Cross-border runs, refrigerated lanes, and expedited freight each come with distinct pricing and cost structures. Local demand patterns determine how often a truck runs loaded versus deadheading. Fuel price swings and freight rate volatility will change day-to-day cash flow. A financial model built for one geography may fail in another. Before buying equipment or signing contracts, model a variety of scenarios, from conservative to optimistic. Build in fuel price increases, maintenance spikes, and occasional empty runs.

Cash flow and financing shape what a trucking business can earn. High gross revenue does not guarantee healthy take-home pay if debt service is high. New trucks financed at aggressive interest rates and long payment terms reduce monthly pressure but increase total interest cost. Leasing can lower up-front cash needs but may impose mileage restrictions or additional fees. Seasonal business cycles mean waiting to be paid is a persistent challenge; quick access to working capital can keep operations moving. Many smaller owners use a cash cushion equivalent to a few months of operating expenses to bridge slow spells.

Finally, consider diversification and long-term positioning. Adding brokerage services, logistics support, or light warehousing can stabilize revenue. Strategic investments in fuel-efficient trucks and workforce development increase competitiveness. Emphasizing compliance and safety reduces insurance premiums and avoids costly violations. A pragmatic, numbers-first approach to each decision often yields the best results. The headline figures—$150k to $300k gross per truck, $40k to $80k net for many owner-operators—are real. They reflect the combined effect of market choice, operational discipline, technology investment, and cost control. For anyone evaluating this business, the path to higher earnings is clear: choose the right lanes, manage costs actively, diversify income, and invest where the math shows a reliable payback.

For context on how transportation affects broader cost and regulatory trends, see the EPA’s resource on transportation and greenhouse gas emissions: https://www.epa.gov/transportation-and-greenhouse-gas-emissions

Behind the Ledger: How Operating Costs Define Your Real Earnings in Trucking

The operating cost structure in trucking reaches far beyond the sticker price of the vehicle. When we talk about ownership costs, we are really discussing the ongoing cash commitments that accompany every mile. The basic categories—fuel, maintenance and repairs, insurance, licensing and permits, tolls, and driver wages if you employ or contract others—form a living budget that can shift with miles, weight, routes, and regulatory changes. Add depreciation and taxes, and the map grows more complex, yet it becomes clearer where the money flows and where profit can be protected. The most straightforward framing comes from established benchmarks. Government and industry analyses point to a baseline annual operating cost for a typical vehicle that is around $11,450, though the figure balloons for commercial trucks that carry heavier loads, enforce stricter maintenance regimes, and operate in more demanding cycles of duty. Those numbers are essential anchors for planning, but they tell only part of the story. For a more granular perspective, the American focus on car and truck costs emphasizes how variable expenses—fuel and maintenance—can swing a business from tight margins to robust cash flow when miles and loads align with favorable costs. Fuel, by far the most volatile element, reacts to markets in real time. A single spike in price or a sudden shift in supply can ripple through a budget, eroding margins that seemed solid a quarter earlier. Fleet operators who deploy fuel management strategies—routing optimization, idle reduction, and equipment that optimizes performance—often see a meaningful lift in profitability, even when load options stay constant. For owner-operators, that arithmetic is personal and immediate, since fuel expense may represent a larger share of each dollar earned than it does for larger fleets with scale and negotiated efficiencies. Maintenance and repairs compound that sensitivity. Heavier usage patterns, specialized equipment, and the wear-and-tear associated with long hauls translate to more frequent service needs and higher parts costs. Insurance premiums, always a careful variable, rise with miles, payload risk, and the regulatory environment. Licensing, permits, and tolls are recurring line items that might not capture as much attention in splashy revenue projections but become critical when calculating monthly cash flow. Depreciation, while not a cash outlay in the day-to-day sense, is a meaningful ongoing consideration for the wealth-building and tax planning aspects of a trucking enterprise. For a lean, hands-on operator, every dollar saved on insurance or fuel can compound into a larger profit pool, while every maintenance delay or permit issue erodes margin. The reality is that the same truck can operate profitably in one market and struggle in another, depending on local demand, regulatory overhead, and the cost of doing business in that region. In the U.S. South, where raw forest products and regional hauls keep a steady rhythm, the cost structure tends to reflect both the intensity of use and the local supply chain dynamics. The data from 2025 highlights a pattern: when an operator can push gross revenue toward the upper end of the spectrum, disciplined cost management matters more than ever. The reason is straightforward. If your revenue climbs but costs climb even faster, profit can stall or shrink. Conversely, if you can either reduce a costly line item or convert more miles into revenue without increasing risk, you improve the odds of a comfortable net. A useful lens is to split costs into fixed and variable buckets. Fixed costs—such as loan or lease payments that don’t move with miles, insurance premiums, and base licenses—require cash every month regardless of how many loads you haul. Variable costs—fuel, maintenance with wear, tolls, and some driver wages—rise and fall with activity. The ratio between these categories helps determine how resilient your business is during slower cycles or price shocks. For instance, if you carry more fixed costs, a lull in demand compresses cash flow more aggressively, while a leaner fixed-cost structure can buffer softer markets. In practical terms, this means choosing between a high-mileage, high-capital model and a lighter, more flexible setup. One scenario that often arises for small operators or owner-operators is a two-truck or solo operation with one or two drivers. Suppose each truck carries a monthly ownership cost in the range of $1,500 to $3,000, a spectrum that includes lease payments or loan amortization. Multiply by two, and you are looking at roughly $3,000 to $6,000 per month in fixed commitments just for debt service, not counting insurance or permits. Add fuel and maintenance, and the monthly tally grows quickly. If fuel costs average around the industry’s heavy-use reality, and maintenance keeps pace with wear and tear, the annual outlay can surpass tens of thousands of dollars. In this context, the revenue you secure must cover not only the cost of moving goods but also the cost of keeping the wheels turning reliably. The emphasis on reliability cannot be overstated. Downtime is expensive. If a truck sits idle due to paperwork, regulatory holds, or mechanical issues, the cost multiplies through fixed payments and lost opportunities. That’s why many operators invest in preventive maintenance schedules and robust compliance processes. The benefit is more predictable uptime, which translates into more miles and more dollars over a year. The math is unforgiving but fair: if you can maintain continuity of operations while controlling the most volatile inputs, your net can climb even when gross fluctuates. A practical way to anchor expectations is by acknowledging the cost baseline and then layering on efficiency measures. You can reduce exposure to fuel volatility by optimizing routes, avoiding empty miles, and using telematics or driver coaching to improve fuel economy. You can moderate insurance costs by maintaining safety records, investing in driver training, and ensuring equipment meets regulatory standards. Licensing and permits can be streamlined with careful planning of your operating authorities and renewal schedules, while toll management—through route selection and, where applicable, toll optimization programs—can shave a meaningful slice off monthly spend. Depreciation should guide long-term decisions about asset replacement cycles, while taxes and incentives may alter the net outcome in ways that aren’t visible in a simple monthly budget but become decisive when filing annual returns. It’s also worth noting how the broader market context shapes these numbers. A robust demand environment can widen margins simply because utilization rises; conversely, a slow market or disruptive policy shifts can compress utilization and pressure pricing. For operators in the U.S. South, where forest products and regional freight flows contribute to steady demand in certain corridors, the best outcomes tend to come from marrying careful cost control with strategic growth in capacity aligned to sustainable demand. An important companion to hard math is the human element. In trucking, people matter—drivers, maintenance technicians, dispatchers, and managers who coordinate miles, budgets, and schedules. The long-run profitability of a small operation often tracks not just the cost per mile but how effectively you allocate time, talent, and training. If you are serious about lifting your earnings, consider an explicit plan to invest in people—training, safety culture, and retention—as a multiplier for equipment investment. This is the kind of strategic focus that many fleets discover to be more decisive than any single price swing. For readers who want to explore the people side of scaling, a deeper dive into investing in people for trucking fleets can illuminate practical pathways to stronger performance, better safety, and steadier revenue streams. investing in people for trucking fleets. While no single path guarantees profit, aligning cost discipline with disciplined growth is how many operators move from surviving to thriving. In closing, the core takeaway is practical and direct: if you want to know how much you can really make, start with the operating cost map. Calibrate your fixed commitments, monitor fuel and maintenance relentlessly, and design your business around reliable miles and compliant operations. Then, regularly refresh projections to reflect changing fuel costs, wage rates, and regulatory obligations. The numbers you gather will be the most honest compass you have for turning potential revenue into real earnings. For a broader benchmark, external data from sources like the Car Cost Statistics study offers ongoing perspective on how vehicle economics shift over time, including the steady drumbeat of maintenance, depreciation, and insurance that underpins every trucking decision. https://www.aaa.com/autocare/article/car-cost-statistics

null

null

Market Demand, Geography, and the Price of Progress: How Location and Demand Shape What You Can Earn Owning a Trucking Business

The earning potential of a trucking business hinges not just on the size of the fleet or the name on the door, but on the subtle dance between demand for moved goods and the geographic realities that shape every mile. When markets heat up and loads proliferate, a truck can move more than just freight; it can move the revenue bar higher. Conversely, when demand taps down or the terrain adds friction, profitability can tighten just as surely as a turn in a winding mountain pass. Understanding this dynamic—how demand flows through the system and how geography channels that flow—helps any owner-operator or small fleet manager translate a topline number into a real, sustainable income.

Market demand is the locomotive of profitability. Freight flows follow the health of industries, consumer behavior, and the architecture of supply chains. In recent observations, when manufacturing ticks up, especially in durable goods and electronics, shipments of raw materials and finished products rise in kind. This surge translates into more loads, higher utilization of available trucks, and, crucially, greater bargaining power for carriers that can service those corridors efficiently. In a global context, certain megatrends illustrate how demand can broaden or tighten. For instance, in 2023, a substantial uptick in the production of new energy vehicles around the world created knock-on demand for batteries, motors, and other components that require reliable, sometimes time-sensitive, freight. The result is more frequent, higher-volume transports across regions that can accommodate longer hauls or expedited schedules. The practical effect for a U.S. operator is that corridors tied to high-growth industrial activity tend to carry elevated rate levels and tighter capacity; those who position themselves to serve these corridors often see the most favorable return on assets.

This reality also intersects with the rise of e-commerce and its insistence on speed. The push toward regional and last-mile deliveries has reshaped where freight moves—favoring shorter, more predictable trips in some cases and, in others, longer regional runs that keep a steady cadence with consumer demand. When demand shifts toward near-market hauls, small fleets can leverage closer proximity to industrial hubs and distribution networks to improve asset utilization. Yet this proximity comes with its own trade-offs. Rates can be volatile, driven by capacity availability and seasonal patterns, while competition for hills and valleys of freight intensifies in high-demand zones. The broader takeaway is clear: markets with robust, diversified demand support steadier tonnage and more predictable earnings, but they also demand nimbleness in capacity planning and pricing.

For the owner aiming to translate demand into dollars, the scale of revenue often sits between the raw figure of gross receipts and the grounded reality of what remains after costs. Industry data from recent years suggests that successful trucking operations in active corridors can generate annual gross revenues ranging roughly from $150,000 to well over $300,000. Yet the true picture for many independent operators in the U.S. South—the heartland for many forest products hauls—shows a more modest after-cost reality. Net profits typically land in the vicinity of $40,000 to $80,000 per year, with exceptional performers pushing beyond the six-figure mark. Those numbers are not a guarantee; they reflect a landscape where demand and geography intertwine with costs, technology, and regulatory obligations.

Among the influential variables, ownership costs loom large. Lease or loan payments for trucks commonly range from about $1,500 to $3,000 per month, a burden that can erode margin if loads are fewer or rates tighten. Fuel prices, a persistent mover of the profit needle, swing with macroeconomic trends and geopolitical forces, and they can erase or enhance a month’s bottom line in a hurry. Maintenance, insurance, permits, and driver wages—each line item in the cost stack—compete for a slice of the revenue pie and are themselves sensitive to geography, climate, and the regulatory environment. Hours-of-service rules and other compliance requirements, while essential for safety and reliability, add administrative overhead and can alter the timing of loads, increasing downtime in some cases while reducing it in others through better scheduling and asset utilization.

Geography then plays the role of a tactical advisor. Transportation networks that are flat, densely populated, and well-connected—where highways, bridges, and rail interchanges create multiple options—tend to yield cost efficiencies. In such regions, fuel consumption per mile can be lower and route planning more straightforward, enabling more predictable service times and higher asset turns. Conversely, rugged terrain, limited infrastructure, or regions dependent on chokepoints and seasonal waterways can raise operating costs in two key ways: longer dry runs and heavier wear on equipment, and higher border, customs, or permit friction when cross-regional moves are necessary. Inland geographies that distance fleets from major ports or hubs often face longer transit times, higher fuel and maintenance burdens, and a more deliberate pace in load matching. If a fleet sits idle or has to wait for a window to move, that idle time depresses net margins even when the gross revenue line looks healthy.

All of this underscores a fundamental strategic principle for owners: align capacity with real demand in the most productive geographies. A well-tuned operation does not chase every available load; it identifies corridors where freight volumes are resilient, rates are stable, and access to drivers and equipment is reliable. The balance is not static. As demand ebbs and flows—seasonal peaks in agricultural regions, holidays that compress or expand delivery windows, or shifts in automotive or electronics manufacturing—so too must the routing and fleet mix adapt. A fleet that can pivot between regional, long-haul, and minimal-idle configurations is better positioned to weather price cycles and keep vehicles moving. In practice, this means careful market intelligence and disciplined asset management. It means knowing which markets are consistently heavy with freight and which routes offer the best blend of fuel efficiency, access to qualified drivers, and favorable rates.

The nuanced takeaway for an owner focused on the bottom line is that both demand and geography are forces that shape, but do not deterministically fix, earnings. Strong demand in high-volume corridors can push up top-line revenue, but if geography imposes excessive costs or sporadic loads, net margins may remain thin. A sustainable business, therefore, hinges on a blend of market awareness, route optimization, and disciplined cost control. Operators who study demand signals—industry activity, manufacturing cycles, and consumer logistics patterns—can time capacity to where loads are most abundant and trusted, while investors and lenders look for a track record of stable utilization and cost discipline that validates the business model in a given region. In this sense, the chapter’s core message is not simply about chasing the largest volumes but about understanding where those volumes exist and how the geography of movement translates into cash flow.

Within this framework, it helps to consider how to apply these insights in practical planning. For example, one might evaluate whether a focused regional strategy in a high-demand corridor yields higher utilization, or whether a diversified approach across several markets provides steadier throughput and reduces exposure to local downturns. Fleet composition can be tailored to the demand profile: a mix of equipment types that match the predominant freight—whether dry van, refrigerated, or flatbed—can improve load acceptance and reduce deadhead. Likewise, driver recruitment and retention strategies become more scalable when anchored to reliable routes with predictable schedules, which in turn reduces volatility in payroll and maintenance cycles. These decisions, however, rest on accurate data about local demand patterns and an honest appraisal of the geographic costs and constraints that exist near home bases and target markets.

For readers who want to ground these observations in current industry context, a useful touchpoint is the ongoing discourse around how market demand is evolving in major freight corridors. See economic trends impacting trailer orders for a lens on how macroeconomic signals translate into capacity shifts and pricing pressure across the broader market. And to widen the lens beyond domestic patterns, recent analyses of global freight activity illustrate how demand surges in large markets can ripple through regional networks, influencing rates, availability, and timing even for operators who live far from the most dynamic hubs. In this broader view, a trucking business remains a local enterprise with global undercurrents—the same miles that traverse hometown routes can also be tethered to international supply chains and the megatrends that drive them.

External reference: China’s Full-Truckload Market Exceeds RMB 3.2 Trillion in 2023, highlighting how demand in a major market can drive capacity constraints and pricing dynamics that ripple through global freight ecosystems. https://www.sohu.com/a/691234567_123456

Real Earnings and Replicable Wins: What Trucking Business Owners Actually Make

Real earnings vary widely, but patterns emerge when you examine successful operations. Ownership income depends on freight type, geography, fleet size, and how tightly the business controls costs. Net results come down to two things: revenue per mile and expense discipline. Look at both together and you can see why some owners earn comfortably six figures while others struggle to break even.

A useful starting point is reported industry averages. Recent surveys indicate owner-operators typically realize net incomes in the neighborhood of $75,000 to $90,000 annually, though many fall above or below that band. Niche operators and well-managed small fleets can push net income past $100,000. In some regional markets, gross revenues can range from roughly $150,000 to more than $300,000, but gross figures hide the heavy costs owners carry: truck payments, fuel, tires, maintenance, insurance, licenses, and driver wages if the owner operates a small fleet.

Concrete success stories help translate percentages into practice. One owner started with a single dry van focused on long-haul lanes. He prioritized predictable lanes, negotiated direct contracts with shippers, and adopted route-optimization tools and load-matching systems. Those moves reduced empty miles and broker fees. Within a few years he moved well into six-figure net territory. Another owner built a refrigerated niche, investing in strict temperature controls and rigorous compliance. By delivering consistently for a handful of regional buyers, she earned reliable premium rates and reached high net profits in year three.

Three consistent strategies appear across high performers. First, specialization and stable contracts. Owners who serve a predictable commodity or a narrow set of lanes can price loads more aggressively. Second, cost control through preventative maintenance and fuel strategies. Keeping trucks on schedule and out of costly repairs boosts uptime and lowers lifetime cost per mile. Third, direct relationships that bypass brokers. When owners secure direct shipper contracts, they avoid intermediary markups and gain revenue stability.

Numbers matter. Typical fixed ownership costs include truck lease or loan payments that often range between $1,500 and $3,000 per month. Insurance, permits, and licensing add thousands annually. Fuel is the largest variable cost and can swing margins rapidly. Maintenance and tires are another sizeable line item; neglecting them raises costs and increases downtime. For a realistic example, consider an operator with $200,000 in annual gross revenue. If that business runs at a 10% net margin, net income will be $20,000. At 15% margin, net income rises to $30,000. That contrast shows why margin improvement tactics can matter more than chasing a slightly higher gross.

Owner-operators commonly aim to increase revenue per mile and cut cost per mile. Revenue strategies include targeting premium freight, adding value with specialized equipment, and avoiding backhauls that pay poorly. Cost strategies include locking in favorable fuel terms, instituting scheduled maintenance, and using telematics to lower idle time and inefficient routing. Some owners secure fixed fuel contracts or fuel cards to reduce volatility. Others invest in training and safety programs to lower insurance premiums and avoid costly violations.

Margins also reflect scale. Small fleets with three to ten trucks can spread administrative overhead and insurance pools. They can also schedule drivers more flexibly and maximize asset utilization. But scaling introduces new costs: payroll complexity, compliance management, and increased working capital needs. Conversely, single-truck owner-operators enjoy low administrative overhead but face higher vulnerability to downtime and market swings.

Risk events reshape earnings. Fuel spikes, regulatory changes, and economic slowdowns compress margins quickly. Cargo theft and disruptions in the supply chain drive up insurance and security costs. Owners who plan for those swings keep reserves and maintain conservative debt levels. Those who over-leverage equipment find themselves squeezed when markets soften.

Operational discipline is where projections turn into paychecks. Successful owners track cost-per-mile daily and review profit-per-load weekly. They measure empty miles, detention minutes, and maintenance intervals. Technology helps, but management decisions are what matter. Regularly comparing performance to industry benchmarks reveals opportunities. For example, a business with a 12% net margin might discover that improving fuel efficiency or cutting broker fees by a few percentage points can add thousands to the bottom line.

People are part of the profit equation. Investing in reliable drivers, training, and fair pay reduces turnover and improves service. That stability makes it easier to win direct contracts and maintain consistent service levels. Industry examples show owners who treated hiring and retention as strategic investments saw better utilization and lower recruitment costs. For insights into workforce-focused strategies, consider the perspectives of industry groups highlighting women and underrepresented drivers reshaping operations and reliability; resources like “Women Driving Change in Trucking Industry” explore this trend and its effects on profitability.

Financial planning matters more than aggressive growth. New entrants should build a conservative pro forma, stress-testing for fuel spikes and seasonal dips. Cash-flow forecasting is essential because a profitable-looking month on paper can become a crisis if invoices lag and payables are due. Lenders and brokers will look for consistent cash management as much as revenue history.

Performance analysis also shows the value of adaptability. Markets shift; freight that pays well this year may weaken next. Top owners diversify revenue streams while maintaining a core focus. They mix contracted lanes with spot-market opportunities to capture higher margins without losing stability. They seek incremental gains—reducing downtime, shortening detention, and improving fuel economy—and compound them into significant profit gains.

Finally, expectations should be realistic. While six-figure net incomes are attainable, they require deliberate choices, strong execution, and a margin-focused mindset. For some, owning a truck is a lifestyle decision more than a wealth-building strategy. For others, especially those who scale carefully and build reliable shipper relationships, ownership becomes a pathway to solid, repeatable earnings.

For a deeper statistical perspective on owner-operator income and benchmarks, refer to the American Trucking Associations’ owner-operator survey for industry-verified data and detailed breakdowns: https://ata.org/research/owner-operator-income-survey

Final thoughts

Owning a trucking business presents a variety of income potentials, influenced by diverse factors including operational costs, market demand, and geographic conditions. This comprehensive analysis equips you, as stakeholders in logistics, construction, fleet management, and food distribution sectors, with crucial insights to navigate the financial landscape effectively. Ultimately, success in this industry requires strategically managing these variables to enhance profitability and secure a sustainable path forward.