As the nation gears up for the inauguration of Donald Trump on January 20, 2025, the trucking industry finds itself on the brink of significant regulatory and environmental shifts. The landscape appears primed for transformation, with industry leaders like American Trucking Associations President Chris Spear expressing cautious optimism about the impending changes.

In a recent meeting, Spear noted, “I feel very confident that we’re going to see waivers being revoked and a new direction being taken with respect to environmental stewardship.” This sentiment reflects a broader hope that the Trump administration will slow down the enforcement of strict electric truck mandates, which are viewed by many operators as an impractical hurdle.

Spear pointed out the stark logistical realities for truckers: filling a diesel truck takes merely 15 minutes for a range of 1,200 miles, while charging an electric truck can take six to eight hours for just 200 miles. The cost disparity is also concerning; electric trucks are three times more expensive than their diesel counterparts.

The stakes are high – as policy developments unfold, the decisions made in the coming months could redefine operational norms, efficiency, and profitability in the trucking sector. With this new administration, trucking operations might just navigate through a landscape more favorable to their needs, yet vigilance is essential as change unfolds.

Chris Spear, President of the American Trucking Associations, has articulated a cautiously optimistic perspective on how the policies of the Trump administration could shape the future of the trucking industry. He believes that the administration’s focus on regulatory relief can significantly benefit trucking operations, particularly in light of electric vehicle (EV) mandates and emission standards that he views as economically impractical for the industry.

Spear has praised the administration’s moves to repeal the stringent Greenhouse Gas Phase 3 (GHG3) emissions standards, which he describes as detrimental to economic viability. He was quoted saying:

“We commend President Trump and EPA Administrator Zeldin for taking decisive action to rescind the disastrous GHG Phase 3 rule. This electric-truck mandate put the trucking industry on a path to economic ruin and would have crippled our supply chain, disrupted deliveries, and raised prices for American families and businesses.”

This sentiment reflects a broader apprehension within the industry regarding the associated costs and logistical challenges of transitioning to electric trucks too rapidly.

In the context of the recent revocation of California’s EV mandates, Spear articulated further optimism, remarking:

“Today, common sense prevailed. We thank President Trump, EPA Administrator Zeldin, and congressional leadership for taking decisive action to end crippling, detached-from-reality rulemakings that would have imposed devastating economic consequences on American businesses and families.”

Despite his focus on regulatory relief, Spear underscores the trucking industry’s commitment to environmental stewardship, noting, “Sixty trucks today emit the same amount as one truck manufactured in 1988.” This highlights the significant advancements in emissions reductions that the industry has already accomplished.

Spear’s comments reflect a cautious yet hopeful outlook for the trucking industry under the Trump administration. He emphasizes the necessity for government and industry collaboration to create realistic, economically feasible environmental standards, ensuring that while progress is made, it does not come at the cost of economic stability. Overall, his perspective reveals a belief that the incoming administration could steer the trucking industry toward a more favorable regulatory environment while maintaining an emphasis on environmental responsibility.

This juxtaposition of optimism regarding regulatory changes with a pragmatic understanding of the industry’s operational realities positions the trucking sector on the brink of transformative change, dependent on future policy directions.

“I think the leading issue we spent most of the time on was environmental,” Spear said of the meeting.

This quote fits seamlessly into the ongoing discussion regarding the environmental impact and regulations affecting the trucking industry. Adding this directly highlights the industry’s focus on addressing environmental concerns amid regulatory changes.

In summary, Chris Spear’s perspective emphasizes the need for manageable regulations that can realistically be achieved without compromising the trucking industry’s operational viability. Stakeholders must navigate these complex issues to ensure sustainable practices align with economic realities moving forward.

This underpinning of environmental considerations will be a key factor as we move through and beyond the current regulatory climate.

| Criteria | Diesel Trucks | Electric Trucks |

|---|---|---|

| Cost | Generally lower initial cost | Three times more expensive |

| Refueling Time | 15 minutes for 1,200 miles | 6-8 hours for about 200 miles |

| Range | Approximately 1,200 miles | Typically around 200 miles |

| Environmental Impact | Higher emissions | Lower emissions potential |

| Practical Implications | Widely adopted, existing infrastructure | Requires significant charging infrastructure and investment |

| Operational Realities | More efficient for long hauls | Best suited for urban, short-haul routes |

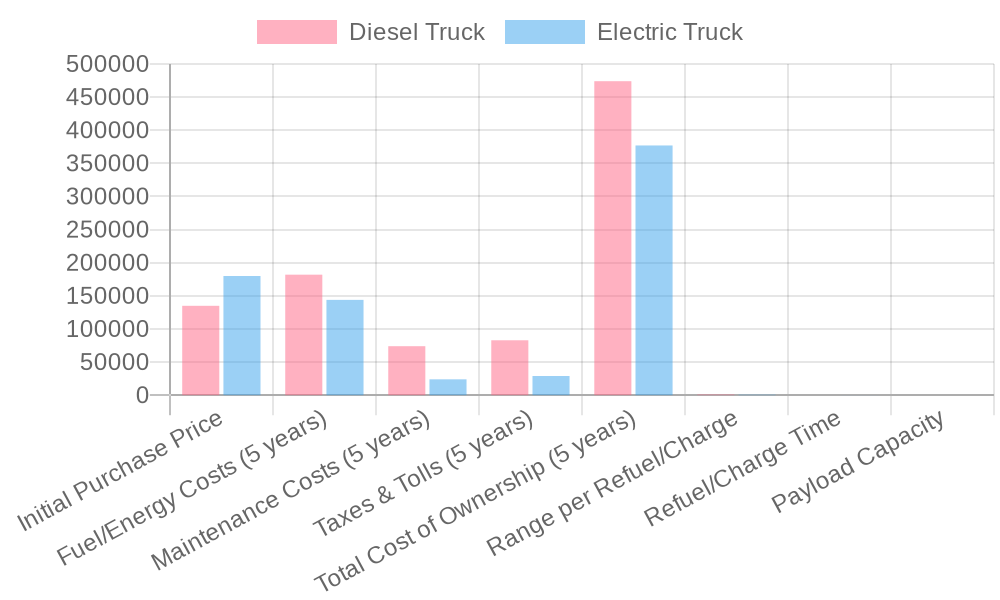

This chart visually compares the overall costs associated with diesel and electric trucks, including key categories like initial purchase price, fueling costs over five years, maintenance expenses, and total cost of ownership. The data highlights how electric trucks, while more expensive upfront, can offer significant savings in fuel and maintenance in the long term, but also face challenges in adoption due to initial costs and infrastructure needs.

Key Insights from the Chart:

- Initial Purchase Price: Diesel trucks generally have a lower initial cost than electric trucks, which can deter some fleet operators from transitioning to electric.

- Fuel Costs: Over five years, electric trucks show cost advantages due to lower fueling expenses compared to diesel.

- Maintenance: Electric trucks tend to have lower maintenance costs due to fewer moving parts.

- Total Cost of Ownership: When assessing the total cost over five years, electric trucks can be more economical despite their higher upfront expenses.

As electric truck technology evolves and the charging infrastructure improves, these cost dynamics may shift further, paving the way for increased adoption in the trucking industry.

Potential Regulatory Changes Under the Trump Administration Affecting the Trucking Industry

The impending administration of Donald Trump is anticipated to bring substantial regulatory shifts that could significantly impact the trucking industry’s operations and environmental policies. As experts in the field express their views, the focus is likely to turn towards deregulation, particularly concerning environmental mandates that have previously posed challenges to trucking operators.

One of the foremost speculated changes involves the repeal of the Greenhouse Gas Emissions Standards for Heavy-Duty Vehicles – Phase 3, which set stringent regulations for emissions from heavy-duty trucks. Critics of these standards argue that they are economically infeasible, and revisions or even complete revocations are seen as probable under the Trump administration. This sentiment has gained traction within industry circles, and observers note that such changes could alleviate the operational constraints currently faced by trucking companies. Moreover, with the administration’s past actions leading to the revocation of California’s stricter vehicle emission regulations, there is a clear trajectory towards reduced regulatory burdens for the industry.

In addition to potential rollbacks of existing mandates, the administration’s inclination to slow down the implementation of new mandates, particularly regarding electric trucks, may reshape operational realities for trucking operators. Industry leaders, including Chris Spear of the American Trucking Associations, have consistently highlighted the impracticality of transitioning too rapidly towards electric vehicles, emphasizing logistical challenges. For instance, refueling a diesel truck for a range of 1,200 miles takes approximately 15 minutes, compared to the six to eight hours required to charge an electric truck for just 200 miles. This stark difference illustrates the operational adjustments that many trucking companies would need to endure amid aggressive environmental mandates.

Moreover, the new administration may foster a regulatory environment that emphasizes economic viability while still promoting environmental stewardship. Although industry advocates stress the need for reasonable environmental standards, there is hope that a balanced approach could emerge—one that aligns sustainability with the economic realities of the trucking sector. Spear commented on this by stating a robust commitment to environmental initiatives while also advocating for practical standards that enhance operational efficiency.

In summary, with the Trump administration poised to take charge, the trucking industry can expect a significant reduction in regulatory pressures, particularly in environmental policies. While speculation remains regarding the specific direction these changes will take, there is cautious optimism among industry leaders regarding the potential for a more favorable operational landscape.

Operational Challenges Faced by Electric Trucks Compared to Diesel Trucks

Transitioning from diesel trucks to electric ones presents significant operational challenges. These challenges are especially evident in three key areas: refueling times, costs, and infrastructure development.

Refueling Times:

Electric trucks take much longer to charge than diesel trucks do to refuel. Filling a diesel truck typically takes about 15 minutes for a distance of 1,200 miles. In contrast, charging an electric truck often requires six to eight hours to achieve just 200 miles of range. This stark difference in downtime can hinder logistics and scheduling in the trucking industry. Chris Spear, President of the American Trucking Associations, highlighted this challenge. He stated,

“It takes 15 minutes to fill a diesel to go 1,200 miles. It takes six to eight hours to charge an electric to go 200 miles. It just can’t be done in five or six years. It’s just impossible.”

Cost Disparities:

The cost of electric trucks poses another barrier. Initial purchase prices for electric trucks can be three times higher than those of diesel trucks. This high initial cost creates a significant financial hurdle for trucking companies, even if electric trucks potentially save money on fuel and maintenance over time.

Infrastructure Development:

Finally, the existing charging infrastructure is not sufficient for widespread adoption of electric trucks. Many rural areas lack access to charging facilities. As a result, truckers may face long delays when trying to charge their vehicles. Industry experts argue that without substantial investments in charging infrastructure, the operational efficiency of electric trucks will lag. Andreas Gorbach, Daimler Truck’s technology chief, emphasized that the pace of infrastructure development is critical to the success of electric vehicles.

As the trucking industry navigates this potential transition, it is essential to address these operational challenges. The combination of extended charging times, higher initial costs, and inadequate infrastructure presents hurdles that could impede the growth and adoption of electric trucks in the short term. This is despite the long-term benefits they may offer.

In conclusion, while electric trucks hold promise for sustainability, significant operational barriers must be addressed to facilitate a smoother transition away from diesel-powered vehicles.

Electric Truck Market Insights

As the electric truck market continues to expand, several key statistics and insights reflect both the progress made and the hurdles that lie ahead in the transition to electric vehicles in the trucking sector.

Adoption Rates of Electric Trucks

- Global Growth: In 2024, global sales of electric medium- and heavy-duty trucks reached over 90,000 units, an almost 80% increase from the previous year. China accounted for a significant portion of this market.

- U.S. Market Insight: The U.S. has seen a dramatic rise in the deployment of electric trucks, with over 10,000 electric trucks put into service in 2023 alone. This marks a significant fivefold increase compared to prior years, cumulatively bringing about 12,894 electric trucks into operation since 2020. Notably, California leads the charge, reporting that one in six new trucks sold are zero-emission vehicles, exceeding the state’s environmental goals.

Challenges Surrounding Electric Truck Infrastructure

Despite these advancements, electric trucks face several challenges:

- High Initial Costs: Electric trucks are typically two to three times more expensive than diesel trucks, making it difficult for fleet operators to transition despite potential savings in fuel and maintenance costs.

- Charging Infrastructure Shortfall: The rapid growth of electric trucks has not been matched by the necessary charging infrastructure. As of September 2024, the U.S. saw a scarcity of public charging stations, with only a 22% growth rate to 176,032 charging units, leading to potential bottlenecks in charging access.

- Battery Technology Limitations: Battery constraints, including limited range and longer charging times, specifically under heavy loads, create operational inefficiencies. This is especially relevant as electric trucks may require up to six to eight hours to charge for just a 200-mile range compared to a diesel truck’s quick 15 minutes for 1,200 miles.

- Regulatory Uncertainty: Varying federal policies and legal challenges present challenges to consistent electric vehicle strategy and planning, creating hesitance among fleet operators.

Market Readiness and Recent Trends

Approximately 59% of commercial fleet owners target expanding their electric truck fleet by 2026, reflecting positive market readiness. However, only 0.14% of the total truck market is currently zero-emission, indicating an uphill battle for widespread adoption.

In conclusion, while the electric truck market shows promising growth with increasing adoption rates, substantial barriers such as high costs, inadequate infrastructure, and technology limitations must be addressed to facilitate a broader transition toward electrification in the trucking industry by meeting the demands of the market head-on.

By tackling these challenges head-on and investing in necessary infrastructure, the trucking industry can aim for a more sustainable future that aligns with emission targets and operational efficiency goals.

Key Challenges in the Transition from Diesel to Electric Trucks

- Refueling Times: Significant disparity where electric trucks require 6-8 hours to charge for 200 miles compared to only 15 minutes for diesel trucks to refuel for 1,200 miles.

- High Initial Costs: Electric trucks can cost three times more than diesel trucks, deterring fleet operators despite potential long-term savings.

- Insufficient Charging Infrastructure: Lack of adequate charging stations, especially in rural areas, poses logistical challenges for electric truck adoption.

- Battery Technology Limitations: Current battery constraints can limit range and efficiency, creating operational inefficiencies under heavy loads.

- Regulatory Uncertainty: Inconsistent policies and legal challenges related to electric vehicle strategies hinder clear planning and implementation by fleet operators.

- Market Resistance: Only a small percentage (0.14%) of the total truck market is currently zero-emission, indicating the scale of the challenge ahead for widespread adoption.

Concluding Thoughts on the Political Implications for the Trucking Industry

As we anticipate the new regulatory landscape under the Trump administration, it’s essential to recognize the delicate balance between optimism and caution that industry stakeholders must navigate. With the potential for significant shifts in environmental policy and regulatory measures, the trucking industry stands at a crossroads that could redefine its operational framework for years to come.

Chris Spear’s insights into the probable easing of stringent regulations highlight a sentiment of hope among trucking professionals, who have long advocated for a more advantageous operating environment. The prospect of reduced red tape surrounding electric vehicle mandates, in particular, is a point of major contention that carries both promise and concerns. On one hand, deregulation might relieve financial pressures and operational constraints, but on the other hand, it raises questions about the long-term sustainability and environmental stewardship of the industry.

Moreover, as we witness the industry grappling with the practical challenges of adopting electric trucks—from high upfront costs to inadequate charging infrastructure—the necessity for well-thought-out and realistic regulatory frameworks becomes even more apparent. Industry leaders must remain vigilant and proactive, advocating for a balanced policy approach that supports innovation without compromising economic viability.

Looking ahead, readers are encouraged to stay informed and engaged as these developments unfold. The future of the trucking industry will undoubtedly hinge on the decisions made in the coming months—a landscape defined not just by political will, but by the collaborative efforts of industry members who strive to create a sustainable, efficient, and economically sound transportation network. The journey may be fraught with challenges, but with prudent navigation, it also holds the potential for unprecedented growth and progress.

Regulatory and Environmental Shifts in the Trucking Industry

As the nation gears up for the inauguration of Donald Trump on January 20, 2025, the trucking industry finds itself on the brink of significant regulatory and environmental shifts. The landscape appears primed for transformation, with industry leaders like American Trucking Associations President Chris Spear expressing cautious optimism about the impending changes. In a recent meeting, Spear noted, “I feel very confident that we’re going to see waivers being revoked and a new direction being taken with respect to environmental stewardship.” This sentiment reflects a broader hope that the Trump administration will slow down the enforcement of strict electric truck mandates, which are viewed by many operators as an impractical hurdle. Spear pointed out the stark logistical realities for truckers: filling a diesel truck takes merely 15 minutes for a range of 1,200 miles, while charging an electric truck can take six to eight hours for just 200 miles. The cost disparity is also concerning; electric trucks are three times more expensive than their diesel counterparts. The stakes are high – as policy developments unfold, the decisions made in the coming months could redefine operational norms, efficiency, and profitability in the trucking sector. With this new administration, trucking operations might just navigate through a landscape more favorable to their needs, yet vigilance is essential as change unfolds.

Addressing Related Keywords for SEO

To further enhance the visibility of this article, keywords such as ‘electric trucks’, ‘California Air Resources Board’, ‘environmental stewardship’, and ‘Trump Administration and Trucking’ have been strategically integrated throughout the content. These keywords not only strengthen the SEO performance but also help in portraying a more comprehensive discussion on the impact of political and environmental factors on the trucking industry.

In summary, the upcoming administration presents a unique opportunity for the trucking industry to advocate for regulations that align with operational realities while still aiming for environmental advancements. The addition of targeted keywords reinforces the article’s relevance in ongoing discussions around these crucial topics.

Outbound Links for Credibility

To support the discussion within this article, various outbound links have been included:

- For insights from the California Air Resources Board, visit their official website for comprehensive information on environmental policies and initiatives aimed at reducing air pollution.

- Explore the U.S. Environmental Protection Agency’s website for details on regulations, enforcement, and their strategies for sustainability in industries, including trucking.