The trucking industry is navigating turbulent waters as it confronts an oversupply of vehicles amidst a downturn in freight demand. This excess capacity in the trucking market is not merely a statistic; it reflects the broader challenges faced by carriers struggling to remain profitable in an environment marked by rising operational costs and diminishing revenue.

As trucking firms grapple with soaring insurance premiums and regulatory pressures, the impact of fluctuating fuel prices compounds the urgency for strategic adaptation. The delicate balance between supply and demand has created a precarious situation, prompting many within the industry to reassess their business models.

In this landscape, a careful analysis of the factors at play is essential for understanding how to navigate these challenges effectively and emerge resilient.

Causes of Excess Capacity in the Trucking Market

The U.S. trucking industry in 2023 is grappling with excess capacity due to several interrelated factors:

- Weak Freight Demand: The industry has experienced a downturn since 2022, characterized by increased capacity, lower rates, and stagnant volumes. This trend is projected to persist beyond 2024, with companies like J.B. Hunt reporting declines in key segments due to the soft freight market.

- Rising Insurance Costs: Insurance premiums have surged, with commercial auto premiums rising by 9.4%. Factors such as social inflation, nuclear verdicts, and reinsurance costs are key drivers. These escalating costs pose a significant threat to the survival of small and mid-sized carriers. Recently, trucking insurance premium costs surged 6% year over year, further burdening operators at a time when profitability is challenged.

- Regulatory Enforcement: The Federal Motor Carrier Safety Administration (FMCSA) has intensified enforcement of English language proficiency requirements for commercial drivers. Since the enforcement began, approximately 12,080 violations have been recorded, leading to instances where 3,126 drivers were placed out of service due to language proficiency issues. This regulatory action can diminish available capacity, impacting firms significantly as they strive to meet compliance while maintaining operational efficiency.

These factors collectively contribute to the excess capacity in the trucking market, creating a challenging environment for carriers striving to maintain profitability. Understanding these underlying causes is essential for the industry to develop informed strategies for managing excess capacity effectively.

| Year | Insurance Costs Increase (%) | Freight Demand Index |

|---|---|---|

| 2020 | 3.5 | 100 |

| 2021 | 5.0 | 95 |

| 2022 | 8.0 | 90 |

| 2023 | 6.0 | 85 |

| 2024 | 4.5 | 80 |

This table visualizes the trends in insurance costs and freight demand, illustrating the correlation between rising insurance premiums and declining demand in the trucking market.

| Trucking Company | Technology Integration | Cost-Cutting Strategies | Market Adaptations |

|---|---|---|---|

| Bay and Bay Transportation | Implementing route optimization software | Reducing fleet size | Focusing on local deliveries |

| J.B. Hunt Transport | Advanced analytics for cargo tracking | Negotiating better fuel contracts | Expanding into e-commerce logistics |

| Schneider National | Utilizing telematics for maintenance tracking | Outsourcing non-core activities | Diversifying services offered |

| Knight-Swift Transportation | Adopting automated logistics platforms | Streamlining operations | Shifting to intermodal transport |

| Werner Enterprises | Investing in AI for predictive analytics | Cost reduction through fleet optimization | Adjusting service offerings to demand |

Impact of Fuel Prices on Trucking Capacity and Profitability

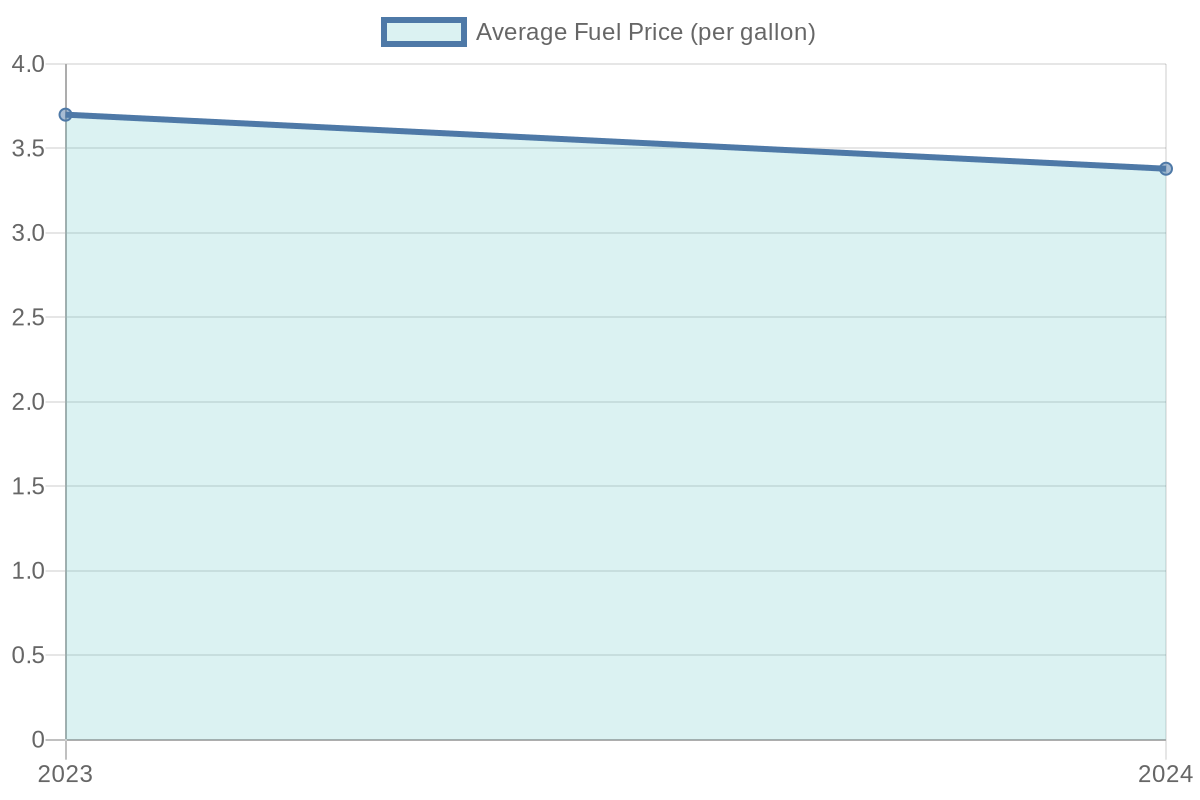

Fluctuating fuel prices significantly impact the trucking industry’s capacity and profitability. Rising fuel costs increase operational expenses, leading to higher freight rates and potential reductions in service areas. Conversely, declining fuel prices can improve market conditions for carriers.

Impact on Trucking Capacity and Profitability

Fuel is a major operational cost for trucking companies, often accounting for 25% to 40% of total expenses. Increases in fuel prices can erode profit margins, forcing carriers to adjust freight rates or reduce services. For instance, a $1.34 per liter increase in fuel prices can raise the annual operational cost of a truck by approximately $16,000 [asmgroupinc.com].

Higher fuel costs can also lead to supply chain disruptions. Fuel shortages or price spikes may delay shipments and push small carriers out of business, thereby reducing overall transportation capacity. Additionally, increased freight costs can raise consumer prices, leading to inflationary pressures [eldtnation.com].

Insights from Industry Experts

Avery Vise, Vice President of Trucking at FTR Transportation Intelligence, notes that rising fuel prices can negatively affect trucking conditions. In February 2024, the Trucking Conditions Index declined due to a sharp rise in fuel prices. Vise forecasts that market conditions for carriers will remain negative but should steadily improve through the third quarter, with more favorable conditions expected in the fourth quarter and into 2025 [trucknews.com].

In August 2023, the Trucking Conditions Index fell to -12.54, the lowest since April 2020, primarily due to higher fuel prices and weaker freight volume. Vise highlighted that surges in fuel prices tend to disproportionately hurt small operations, as they are less likely to benefit from fuel surcharges [ccjdigital.com].

While specific insights from Sam Anderson are not available in the provided sources, the general consensus among industry experts is that fuel price volatility poses significant challenges to trucking capacity and profitability.

Implications for Trucking Companies and the Market

Trucking companies must adopt strategies to mitigate the impact of fuel price fluctuations. These include investing in fuel-efficient technologies, optimizing routes, and implementing fuel surcharges to pass increased costs onto shippers. Additionally, companies can explore alternative energy sources and nearshoring approaches to reduce transportation distances and fuel consumption [asmgroupinc.com].

For the broader market, fluctuating fuel prices can lead to increased freight rates, supply chain disruptions, and inflationary pressures. Shippers and consumers may face higher costs, and smaller carriers may struggle to remain profitable, potentially leading to reduced competition and capacity in the industry.

In summary, fluctuating fuel prices have a profound impact on the trucking industry’s capacity and profitability. Industry experts like Avery Vise emphasize the challenges posed by fuel price volatility and the need for strategic adaptations to navigate these fluctuations.

Coping Strategies for Trucking Firms Managing Excess Capacity

As the trucking industry faces a precarious landscape marked by excess capacity and dwindling freight demand, firms are tasked with making critical adaptations to survive and thrive. The following strategies provide actionable insights for trucking firms navigating this turbulent market:

- Fleet Adjustments: To manage excess capacity, firms may consider downsizing their fleets by selling or leasing out underutilized vehicles. This strategy not only reduces operational costs but also allows companies to invest in improving the remaining fleet’s efficiency.

- Technological Innovation: Embracing technological adoption through predictive analytics, automation, and artificial intelligence is essential. These tools can enhance demand forecasting, optimize routing, and streamline resource management, ultimately increasing operational efficiency and reducing costs. For instance, companies that implement route optimization software can significantly reduce mileage and fuel consumption, improving overall profitability. (source)

- Diversifying Offerings: Firms should consider expanding their service offerings and exploring new geographical markets or industry verticals, which can help them adapt to shifting demand patterns. By diversifying their operations, trucking companies can mitigate risks associated with reliance on specific sectors, thus maintaining a steadier revenue stream during economic fluctuations. (source)

- Balancing Contract and Spot Market Exposure: Adjusting the mix of contract versus spot market freight allows firms to manage risk effectively. By using data analytics to determine the optimal ratio, trucking companies can maximize their profits while navigating the uncertainties of fluctuating freight rates. (source)

- Extending Equipment Lifecycles: In response to economic pressures, firms can focus on prolonging the lifecycles of their equipment through enhanced maintenance practices. By ensuring that older models remain operational and reliable, trucking companies can defer costly new purchases and better manage their cash flow. (source)

- Cost Efficiency: A critical aspect of maintaining profitability is focusing on cost efficiency. Firms should leverage technological solutions to optimize routes and reduce fuel consumption while reviewing their insurance coverage to identify potential savings, minimizing administrative burdens that could strain operational budgets. (source)

- Driver Retention: Keeping experienced drivers is vital for operational continuity. Companies can prioritize driver satisfaction by fostering open communication about market conditions, exploring competitive compensation structures, and implementing recognition programs that boost morale and loyalty among staff. (source)

By implementing these coping strategies, trucking firms can navigate the challenges posed by excess capacity and create a more resilient framework for the future. Adaptability and innovation are crucial for thriving amid uncertainty, laying the groundwork for sustained growth in the evolving freight market.

Coping Strategies for Trucking Firms Managing Excess Capacity

As the trucking industry faces a precarious landscape marked by excess capacity and dwindling freight demand, firms are tasked with making critical adaptations to survive and thrive. The following strategies provide actionable insights for trucking firms navigating this turbulent market:

-

Fleet Adjustments: To manage excess capacity, firms may consider downsizing their fleets by selling or leasing out underutilized vehicles. This strategy not only reduces operational costs but also allows companies to invest in improving the remaining fleet’s efficiency.

-

Technological Innovation: Embracing technological adoption through predictive analytics, automation, and artificial intelligence is essential. These tools can enhance demand forecasting, optimize routing, and streamline resource management, ultimately increasing operational efficiency and reducing costs. For instance, companies that implement route optimization software can significantly reduce mileage and fuel consumption, improving overall profitability. (source)

-

Diversifying Offerings: Firms should consider expanding their service offerings and exploring new geographical markets or industry verticals, which can help them adapt to shifting demand patterns. By diversifying their operations, trucking companies can mitigate risks associated with reliance on specific sectors, thus maintaining a steadier revenue stream during economic fluctuations. (source)

-

Balancing Contract and Spot Market Exposure: Adjusting the mix of contract versus spot market freight allows firms to manage risk effectively. By using data analytics to determine the optimal ratio, trucking companies can maximize their profits while navigating the uncertainties of fluctuating freight rates. (source)

-

Extending Equipment Lifecycles: In response to economic pressures, firms can focus on prolonging the lifecycles of their equipment through enhanced maintenance practices. By ensuring that older models remain operational and reliable, trucking companies can defer costly new purchases and better manage their cash flow. (source)

-

Cost Efficiency: A critical aspect of maintaining profitability is focusing on cost efficiency. Firms should leverage technological solutions to optimize routes and reduce fuel consumption while reviewing their insurance coverage to identify potential savings, minimizing administrative burdens that could strain operational budgets. (source)

-

Driver Retention: Keeping experienced drivers is vital for operational continuity. Companies can prioritize driver satisfaction by fostering open communication about market conditions, exploring competitive compensation structures, and implementing recognition programs that boost morale and loyalty among staff. (source)

By implementing these coping strategies, trucking firms can navigate the challenges posed by excess capacity and create a more resilient framework for the future. Adaptability and innovation are crucial for thriving amid uncertainty, laying the groundwork for sustained growth in the evolving freight market.

Technology Adoption in the Trucking Industry

The trucking sector has seen a significant increase in adopting new technologies. Many companies are now using telematics and freight matching platforms to manage excess capacity and improve operations. By 2025, about 25 million GPS and dashcam devices will be managing commercial fleets in the U.S. This shows a big shift towards using telematics. The telematics software market is expected to grow from USD 11.94 billion in 2025 to USD 40.03 billion by 2035, at a growth rate of 16.4%. In North America, over 12 million trucks are already connected through GPS and Electronic Logging Device (ELD) systems, making up 75% of commercial fleets.

These technologies are vital for overcoming capacity challenges. Freight matching platforms use real-time data to assign loads, which helps reduce empty miles and maximize truck usage. Predictive maintenance through telematics keeps track of vehicle health, which cuts down on unexpected breakdowns and keeps trucks ready for cargo. Additionally, telematics-driven route optimization can streamline operations. This not only saves fuel but also enhances fleet resource utilization.

In summary, the rise of telematics and freight matching solutions is a smart response to the ongoing issues of excess capacity in trucking. They offer a way to boost efficiency and sustainability in operations.

Additional Trends in Trucking Technology

- Increased Use of Technology: Advanced technologies like Transportation Management Systems (TMS) and Electronic Logging Devices (ELDs) are making fleet management easier, improving fuel efficiency, and optimizing routes. [Freight Center]

- Autonomous Trucking: Self-driving trucks with AI and sensors are becoming more common. These vehicles improve delivery speed and reduce labor costs. Features such as adaptive cruise control and radar safety systems are being integrated, with self-driving semis expected on the roads this year. [Freight Center]

- Electric and Alternative-Fuel Vehicles: The industry is shifting toward electric and hybrid-electric trucks to lessen environmental impact. This move is driven by government regulations and industry sustainability initiatives. [Freight Center]

- Artificial Intelligence (AI) Integration: AI is changing fleet operations by improving load matching, route planning, and fuel usage. AI-powered fleet management software can increase weekly truck revenue by up to 24% [90 Day Freight Broker].

- Digital Freight Matching Platforms: Digital freight marketplaces are transforming how shippers and carriers connect. These platforms enhance pricing, visibility, and load matching in real time. [Simple Truck Tax].

- Driver Well-Being and Retention Tools: Technologies focusing on driver experience, like fatigue monitoring and optimized route planning, are being prioritized to tackle driver shortages and boost retention rates. [DQM Connect].

These trends show a transformative era for the trucking industry, with technology playing a key role in its future.

Conclusion

In conclusion, the current state of excess capacity in the trucking market presents both challenges and opportunities for industry stakeholders. Throughout this article, we have explored the multifaceted causes of this issue, including weak freight demand, rising operational costs, and regulatory changes. The importance of addressing these factors cannot be overstated; companies must formulate strategies to navigate this challenging environment effectively.

As we look ahead, it is critical for trucking firms to implement adaptive strategies such as fleet adjustments, technological innovation, and improved cost efficiency. These measures will not only mitigate the impacts of excess capacity but also position companies for recovery as market conditions stabilize. The road ahead will require a cautious yet proactive approach, emphasizing the need to embrace change and harness new technologies.

Ultimately, addressing excess capacity in the trucking market is not merely about survival—it’s a crucial step towards fostering long-term sustainability and profitability within this vital sector. As the landscape evolves, trucking companies that remain vigilant and adaptive will emerge stronger and more competitive, paving the way for a more resilient future in freight transportation.

Industry Expert Insights

Incorporating insights from industry experts can greatly enhance our understanding of the current trucking landscape. Sam Anderson, CEO of Bay and Bay Transportation, highlights the need for careful planning amid excess capacity:

“We made cuts over the last 18 months to get down to the size that makes more sense for this environment. We are planning the market doesn’t change a lot in the next 12 to 18 months, so we’re going to continue to try to improve our costs.”

Avery Vise, Vice President of Trucking at FTR Transportation Intelligence, comments on the persistent overcapacity issue:

“We still have this very real overhang of small carriers who are not exiting the business. This is going to be a capacity-driven recovery of utilization, not a freight-demand-driven recovery.”

Additionally, Vise has noted the significant impact of rising insurance premiums on the industry:

“Trucking insurance premium costs surged to levels never seen before, up 6% year over year… It feels like it’s not sustainable for a lot of carriers.”

These insights underscore the complex dynamics in the trucking industry, where excess capacity, rising operational costs, and market recovery are tightly intertwined.

In this challenging environment, a deeper exploration of the factors contributing to excess capacity is essential. By understanding the specific causes, trucking firms can respond proactively and develop informed strategies tailored to navigate this turbulent market effectively.

The trucking industry is navigating turbulent waters as it confronts an oversupply of vehicles amidst a downturn in freight demand. This excess capacity in the trucking market is not merely a statistic; it reflects the broader challenges faced by carriers struggling to remain profitable in an environment marked by rising operational costs and diminishing revenue. As trucking firms grapple with soaring insurance premiums and regulatory pressures, the impact of fluctuating fuel prices compounds the urgency for strategic adaptation. The delicate balance between supply and demand has created a precarious situation, prompting many within the industry to reassess their business models. In this landscape, a careful analysis of the factors at play is essential for understanding how to navigate these challenges effectively and emerge resilient in the quest for trucking market sustainability.

Causes of Excess Capacity in the Trucking Market

The U.S. trucking industry in 2023 is grappling with excess capacity due to several interrelated factors:

- Weak Freight Demand: The industry has experienced a downturn since 2022, characterized by increased capacity, lower rates, and stagnant volumes. This trend is projected to persist beyond 2024, with companies like J.B. Hunt reporting declines in key segments due to the soft freight market. The ongoing freight demand challenges have put further strain on trucking firms.

- Rising Insurance Costs: Insurance premiums have surged, with commercial auto premiums rising by 9.4%. Factors such as social inflation, nuclear verdicts, and reinsurance costs are key drivers. These escalating costs pose a significant threat to the survival of small and mid-sized carriers. Recently, trucking insurance premium costs surged 6% year over year, further burdening operators at a time when profitability is challenged.

- Regulatory Enforcement: The Federal Motor Carrier Safety Administration (FMCSA) has intensified enforcement of English language proficiency requirements for commercial drivers. Since the enforcement began, approximately 12,080 violations have been recorded, leading to instances where 3,126 drivers were placed out of service due to language proficiency issues. This regulatory action can diminish available capacity, impacting firms significantly as they strive to meet compliance while maintaining operational efficiency.

These factors collectively contribute to the excess capacity in the trucking market, creating a challenging environment for carriers striving to maintain profitability. Understanding these underlying causes is essential for the industry to develop informed strategies for managing excess capacity effectively.

Impact of Fuel Prices on Trucking Capacity and Profitability

Fluctuating fuel prices significantly impact the trucking industry’s capacity and profitability. Rising fuel costs increase operational expenses, leading to higher freight rates and potential reductions in service areas. Conversely, declining fuel prices can improve market conditions for carriers.

Fuel is a major operational cost for trucking companies, often accounting for 25% to 40% of total expenses. Increases in fuel prices can erode profit margins, forcing carriers to adjust freight rates or reduce services. For instance, a $1.34 per liter increase in fuel prices can raise the annual operational cost of a truck by approximately $16,000 (asmgroupinc.com). Higher fuel costs can also lead to supply chain disruptions. Fuel shortages or price spikes may delay shipments and push small carriers out of business, thereby reducing overall transportation capacity. Additionally, increased freight costs can raise consumer prices, leading to inflationary pressures (eldtnation.com).

Coping Strategies for Trucking Firms Managing Excess Capacity

As the trucking industry faces a precarious landscape marked by excess capacity and dwindling freight demand, firms are tasked with making critical adaptations to survive and thrive. The following strategies provide actionable insights for trucking firms navigating this turbulent market, especially focusing on trucking market sustainability:

- Fleet Adjustments: To manage excess capacity, firms may consider downsizing their fleets by selling or leasing out underutilized vehicles. This strategy not only reduces operational costs but also allows companies to invest in improving the remaining fleet’s efficiency.

- Technological Innovation: Embracing technological adoption through predictive analytics, automation, and artificial intelligence is essential. These tools can enhance demand forecasting, optimize routing, and streamline resource management, ultimately increasing operational efficiency and reducing costs. For instance, companies that implement route optimization software can significantly reduce mileage and fuel consumption, improving overall profitability (source).

- Diversifying Offerings: Firms should consider expanding their service offerings and exploring new geographical markets or industry verticals, which can help them adapt to shifting demand patterns. By diversifying their operations, trucking companies can mitigate risks associated with reliance on specific sectors, thus maintaining a steadier revenue stream during economic fluctuations (source).

- Balancing Contract and Spot Market Exposure: Adjusting the mix of contract versus spot market freight allows firms to manage risk effectively. By using data analytics to determine the optimal ratio, trucking companies can maximize their profits while navigating the uncertainties of fluctuating freight rates (source).

- Extending Equipment Lifecycles: In response to economic pressures, firms can focus on prolonging the lifecycles of their equipment through enhanced maintenance practices. By ensuring that older models remain operational and reliable, trucking companies can defer costly new purchases and better manage their cash flow (source).

- Cost Efficiency: A critical aspect of maintaining profitability is focusing on cost efficiency. Firms should leverage technological solutions to optimize routes and reduce fuel consumption while reviewing their insurance coverage to identify potential savings, minimizing administrative burdens that could strain operational budgets (source).

- Driver Retention: Keeping experienced drivers is vital for operational continuity. Companies can prioritize driver satisfaction by fostering open communication about market conditions, exploring competitive compensation structures, and implementing recognition programs that boost morale and loyalty among staff (source).

Conclusion

In conclusion, the current state of excess capacity in the trucking market presents both challenges and opportunities for industry stakeholders. Throughout this article, we have explored the multifaceted causes of this issue, including weak freight demand, rising operational costs, and regulatory changes. The importance of addressing these factors cannot be overstated; companies must formulate strategies to navigate this challenging environment effectively while considering sustainability in the trucking market.

Ultimately, addressing excess capacity in the trucking market is not merely about survival—it’s a crucial step towards fostering long-term sustainability and profitability within this vital sector. As the landscape evolves, trucking companies that remain vigilant and adaptive will emerge stronger and more competitive, paving the way for a more resilient future in freight transportation.