In recent years, the trucking industry has faced an increasingly complex landscape due to stringent emissions regulations set forth by Original Equipment Manufacturers (OEMs). These regulations aim to significantly reduce harmful emissions, notably nitrogen oxides (NOx), with an ambitious target of an 82.5% reduction by 2027.

However, the fluctuating standards and the lack of clarity across regions, particularly between Canada and the U.S., pose notable challenges for fleet operators. As they contemplate substantial investments in zero-emission technologies, the urgency to navigate these regulatory hurdles has never been more critical. Without a clear framework, fleets may find themselves in a precarious position, faced with the risk of being unprepared for compliance, which can lead to missed opportunities and increased operational costs.

Addressing these challenges proactively is essential not only for ensuring regulatory adherence but also for fostering sustainable investments that align with the industry’s future.

As the U.S. Environmental Protection Agency (EPA) finalizes this new rule, it targets a drastic reduction in nitrogen oxides (NOx) emissions. Specifically, this regulation aims for an ambitious 82.5% reduction from the current standard of 0.2 grams per horsepower-hour (g/hp/hr) to a mere 0.035 g/hp/hr by the year 2027.

This progressive shift illustrates the federal intent to curb air pollution and enhance air quality, which is crucial given the increasing pressure from environmental activists and public health advocates. The introduction of the EPA27 NOx rule signifies a critical milestone in the evolution of emission standards, compelling Original Equipment Manufacturers (OEMs) to adapt accordingly.

As stakeholders in the trucking industry gear up for compliance, the challenges are multifaceted and continue to evolve. The complexities arise from both the technical capabilities required to meet these stringent changes in emissions control technology and the economic implications for fleet operators investing in newer, cleaner engines.

OEMs have been preparing for this transition over the past five to seven years, emphasizing the urgency to meet the forthcoming standards. Leaders within the sector, such as Sean Waters of Daimler Truck North America, have highlighted that securing clarity in these regulations is essential for strategic planning and investment in emission-reduction technologies.

Moreover, the regulations remain contentious within the industry, as many OEMs seek consistency between the standards in the U.S. and those in Canada. This desire for a unified approach stems from the fact that over 4 million vehicles cross the U.S.-Canada border yearly, making regulatory alignment crucial for fleet operations that traverse this international boundary.

| Criteria | Canada | United States |

|---|---|---|

| Current NOx Emissions Standards |

|

|

| Upcoming Emissions Standards |

|

|

| Key Changes Under New Regulations |

|

|

| Sector Coverage |

|

|

| Rationale for Changes |

|

|

| Current Timeline |

|

|

Impact of Regulatory Uncertainty on Investment Decisions

The ambiguity surrounding emissions standards has emerged as a significant barrier to investment in clean technologies for fleet operators. OEMs find themselves in a precarious situation, where the lack of clear and consistent regulations creates hesitancy in adopting new, cleaner technologies. Fleet managers are often reluctant to make substantial investments in vehicles and infrastructure that may soon be rendered obsolete by shifting regulatory landscapes.

For instance, if emissions standards remain undefined or change frequently, fleets may delay purchasing new vehicles that comply with the anticipated regulations. This hesitancy not only prolongs the reliance on older, less efficient vehicles but also postpones the necessary transition to zero-emission alternatives. As fleets hold back on essential upgrades, they risk falling behind competitors who may choose to take the plunge, provided there is regulatory clarity.

Moreover, the hesitancy to adopt new technologies driven by unclear emissions standards results in a broader market impact. It disrupts the innovation cycle within the trucking industry, as manufacturers may be unwilling to invest in R&D for new emissions-compliant vehicles without a solid understanding of future regulations. Consequently, this uncertainty stifles advancements in emissions reduction technologies, as the commercial viability for such investments appears risky.

The cycle of uncertainty creates a ripple effect, where young companies working on innovative technologies struggle to secure funding without assurance that their products will meet future market demands. Investors, in turn, become wary of putting capital into fleets that may be hesitant to adopt new technologies based on shifting regulatory requirements.

As exemplified in discussions among industry leaders, there is a collective call for clarity and consistency in emissions standards. This consensus reflects a broader understanding that providing a definitive regulatory framework is not merely a bureaucratic necessity; it is essential for driving the transition towards sustainable fleet operations and ensuring that OEMs can innovate without fear of obsolescence. Ultimately, the impact of regulatory uncertainty can have lasting repercussions on fleet strategies and the pace at which the industry evolves towards more sustainable practices.

Impact of Regulatory Uncertainty on Investment Decisions

- The ambiguity surrounding emissions standards significantly hinders investments in clean technologies for fleet operators.

- OEMs are hesitant to adopt new, cleaner technologies due to unclear and inconsistent regulations.

- This lack of clarity often leads to delays in purchasing new vehicles, prolonging the use of older, less efficient models.

- As fleets wait for clear regulations, they risk lagging behind competitors who may be willing to invest.

- Uncertainty in standards disrupts the innovation cycle within the trucking industry, with manufacturers wary of investing in R&D for new technologies.

- Young companies may struggle to secure funding without assurance of future market demands.

- A collective call for clarity and consistency in emissions standards reflects a broader understanding of its importance for sustainable fleet operations.

- Clarity in regulations is essential for enabling OEM innovation without fear of obsolescence, directly affecting fleet strategies and industry evolution.

Insights from Industry Leaders on Regulatory Challenges

Industry leaders have consistently highlighted the need for clarity and consistency in emissions regulations to effectively navigate the challenges faced by the trucking industry. Sean Waters, Vice President of Product Compliance and Regulatory Affairs at Daimler Truck North America, expressed significant concerns about the ambiguity in regulatory expectations. He stated,

“We don’t know what we have to be prepared for, or what we are up against,”

illuminating the uncertainties that arise from inconsistent emissions regulation.

Furthermore, Waters pointed out the inadequacies in charging infrastructure for heavy-duty electric trucks, remarking,

“Frankly, this country is not ready yet for charging for heavy duty trucks.”

His statement underscores the intersection of regulatory decisions and the technological readiness required to meet future challenges.

Krista Toenjes, General Manager of On-Highway Business at Cummins, reinforced this sentiment, emphasizing the industry’s urgent need for definitive regulatory guidance:

“We just want a decision one way or another. We need clarity on that.”

This underscores a collective understanding within the trucking sector that without clear guidelines, companies struggle to forge effective investment strategies.

Both Waters and Toenjes highlight the pressing consequences associated with regulatory uncertainty. They advocate that clear and consistent emissions regulations are not merely bureaucratic necessities; they are critical to ensuring compliance and fostering strategic planning and innovation within the industry. Without this clarity, the trucking sector risks stagnating in its shift toward greener, more sustainable solutions.

Challenges Faced by OEMs in Navigating Regulatory Compliance

Original Equipment Manufacturers (OEMs) face a myriad of challenges when it comes to adhering to regulatory compliance, particularly with regard to emissions standards that are becoming increasingly stringent. One of the primary hurdles is the often high costs associated with adapting existing technologies to meet new regulations. The compliance process involves significant investments in research and development, manufacturing adjustments, and modifications to existing product lines. For many OEMs, particularly smaller manufacturers, these costs can be prohibitively high, leading to concerns about overall profitability and market viability.

Moreover, the rapid pace of regulatory change can create an environment of unpredictability. With new emissions standards being introduced sporadically, OEMs must continually invest in technology that may only be relevant for a brief time frame. This cyclical nature of compliance can lead to a scenario where companies are constantly playing catch-up, diverting resources away from innovation and towards compliance efforts.

Additionally, OEMs must carefully strategize their long-term fleet management plans, which are heavily influenced by these regulations. For example, the impending 2027 NOx standards necessitate that OEMs not only adapt their current offerings but also develop forward-looking strategies that account for potential regulatory shifts. This type of strategic planning requires comprehensive market analysis and foresight to predict how regulations may evolve, creating an additional layer of complexity for manufacturers.

Furthermore, the inconsistencies in regulations across different regions, especially between the U.S. and Canada, add another challenging dimension for OEMs. The lack of harmonization means OEMs must navigate a patchwork of compliance requirements, which can complicate manufacturing and distribution processes. This fragmentation of standards makes it difficult for companies to implement uniform strategies across their fleets, threatening operational efficiency.

In conclusion, the challenges faced by OEMs regarding regulatory compliance are multi-faceted, involving significant adaptation costs, strategic planning complexities, and a need for regional regulatory coherence. To thrive in this challenging environment, it is essential that OEMs maintain agility in their operations and remain proactive in their compliance strategies, ensuring they are well-prepared for future regulatory shifts.

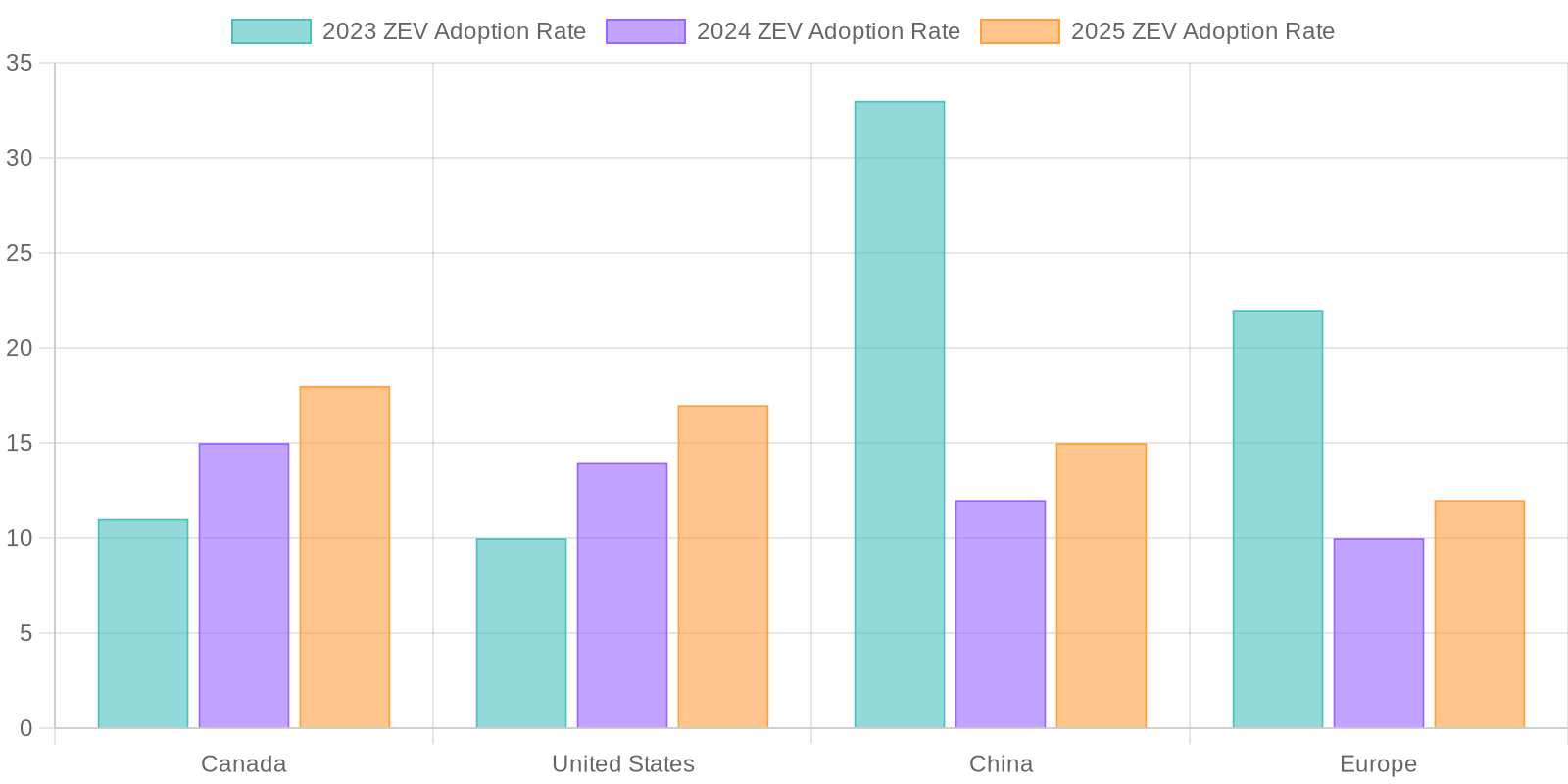

User Adoption Trends in Zero-Emission Vehicles

The adoption of zero-emission vehicles (ZEVs), such as electric vehicles (EVs), is on an upward trajectory across various regions, influenced by a combination of regulatory frameworks, incentives, and public awareness initiatives. Below is a summary of the current trends in user adoption rates:

Global Adoption Rates and Trends

- Canada: By the fourth quarter of 2024, ZEVs accounted for 18.9% of new vehicle registrations, exceeding earlier projections. Notably, Quebec led in ZEV adoption, with 42% of new registrations being zero-emission. [Electric Autonomy]

- United States: The number of zero-emission transit buses rose significantly. By July 2024, the fleet of full-size zero-emission buses reached 7,028, a 14% increase from the prior year, predominantly driven by battery-electric models. [Calstart]

- Europe: Between January and June in 2025, the registration of battery electric vehicles surged by 34% compared to the same period in 2024. Germany remained the largest market for BEVs, supported by strong consumer incentives. [European Alternative Fuels Observatory]

- China: Leading the global market, China reported over 11 million EV sales in 2025, accounting for more than half of global sales. BYD surpassed Tesla in battery electric vehicle sales in 2024, with a 25% increase year-on-year. [Reuters]

Influence of Regulatory Frameworks

- European Union: The EU aims for a 100% reduction in carbon emissions from new vehicles by 2035, maintaining its firm stance amidst regulatory compliance extensions. [Reuters]

- United States: The Biden administration has adjusted automotive emissions standards for 2027-2029, aiming to recover the original reduction target by 2032 in light of slowing EV sales. [AP News]

- Canada: New amendments mandate that zero-emission vehicles comprise at least 20% of sales by 2026, increasing to 100% by 2035. [IEA]

- United Kingdom: Legislation now requires that 22% of new sales be zero-emission vehicles in 2024, rising to 80% by 2030. [IEA]

Impact of Policies on Adoption Rates

Research suggests that stringent environmental policies promoting EV adoption have a more significant influence than mere financial incentives. Tax credits for EV purchases have proven more effective than rebates, while increasing public familiarity with EVs through various programs enhances overall acceptance and integration into everyday life. [ScienceDirect]

In summary, the growth of zero-emission vehicle adoption is primarily driven by regulatory frameworks and market incentives. As challenges such as infrastructure readiness persist, the momentum toward sustainable transportation options continues to build.

Conclusion

In conclusion, the necessity for clarity in emissions regulations cannot be overstated. As the trucking industry faces unprecedented challenges stemming from regulatory ambiguity, it becomes increasingly clear that a well-defined framework is essential. Without clear emissions standards, Original Equipment Manufacturers (OEMs) and fleet operators find themselves in a precarious position, inhibiting their ability to make informed and strategic investments in cleaner technologies. The hesitancy to adopt zero-emission vehicles and comply with emerging regulations not only slows the transition to sustainable practices but also risks economic viability in a competitive marketplace.

Streamlined and consistent emissions regulations can serve as a catalyst for the industry, providing a roadmap that encourages innovation while fostering investor confidence. A collaborative approach between policymakers and industry stakeholders is essential to develop comprehensive guidelines that align with environmental objectives while also addressing the practical needs of the trucking sector. By establishing clear, actionable standards, the risk of obsolescence in fleet investments can be mitigated, paving the way for a more sustainable and economically viable future. The data suggests that clarity in regulations not only supports compliance but also unlocks opportunities for sustainable growth and technological advancement, thereby enabling fleet operators to contribute to a cleaner environment while remaining competitive. Ultimately, decisive action towards regulatory clarity is not only a necessity but an opportunity to lead in the global shift towards sustainable transportation solutions.

Introduction

In recent years, the trucking industry has faced an increasingly complex landscape due to stringent emissions regulations set forth by Original Equipment Manufacturers (OEMs). These regulations aim to significantly reduce harmful emissions, notably nitrogen oxides (NOx), with an ambitious target of an 82.5% reduction by 2027. However, the fluctuating standards alongside the lack of clarity across regions, particularly between Canada and the U.S., pose notable challenges for fleet operators. As they contemplate substantial investments in zero-emission technologies and emissions reduction strategies, the urgency to navigate these regulatory hurdles has never been more critical. Without a clear framework, fleets risk being unprepared for compliance, leading to missed opportunities and increased operational costs. Addressing these challenges proactively is essential not only for ensuring regulatory adherence but also for fostering sustainable investments aligned with the industry’s future.

Current State of Emissions Regulations

As the U.S. Environmental Protection Agency (EPA) finalizes this new rule, it targets a drastic reduction in nitrogen oxides (NOx) emissions. Specifically, this regulation aims for an ambitious 82.5% reduction from the current standard of 0.2 grams per horsepower-hour (g/hp/hr) to a mere 0.035 g/hp/hr by the year 2027.

This progressive shift illustrates the federal intent to curb air pollution and enhance air quality, which is crucial given the increasing pressure from environmental activists and public health advocates. The introduction of the EPA27 NOx rule signifies a critical milestone in the evolution of emission standards, compelling Original Equipment Manufacturers (OEMs) to adapt accordingly while also investing in zero-emission technology.

As stakeholders in the trucking industry gear up for compliance, the challenges are multifaceted and continue to evolve. The complexities arise from both the technical capabilities required to meet these stringent changes in emissions control technology and the economic implications for fleet operators investing in cleaner, zero-emission vehicles.

OEMs have been preparing for this transition over the past five to seven years, emphasizing the urgency to meet the forthcoming standards. Leaders within the sector, such as Sean Waters of Daimler Truck North America, have highlighted that securing clarity in these regulations is essence for strategic planning and investment in emissions reduction strategies.

Moreover, the regulations remain contentious within the industry, as many OEMs seek consistency between the standards in the U.S. and those in Canada. This desire for a unified approach stems from the fact that over 4 million vehicles cross the U.S.-Canada border yearly, making regulatory alignment crucial for fleet operations that traverse this international boundary.