The Tesla Cybertruck has long been a topic of conversation in the electric vehicle world, but recent changes to its pricing dynamics have shifted the landscape significantly.

Gone is the Rear-Wheel Drive model, which had served as the entry-level option for budget-conscious consumers. With its elimination, the entry price for this groundbreaking electric truck is now set at a staggering $82,235, raising questions about accessibility for new buyers.

This move may impact Tesla’s ambitions for sales growth and market penetration, as the recent figures indicate a slowdown in demand; only 24,000 units were sold last year, with just 15,000 being sold in the first half of this year.

As enthusiasts and potential customers grapple with the implications of this change, it will be interesting to see how it affects the Cybertruck’s sales trajectory and Tesla’s position in a competitive market.

Tesla’s New Pricing Strategy for the Cybertruck

As of September 2025, Tesla has made major changes to its pricing strategy for the Cybertruck. The starting price for the base model is now $82,235, after eliminating the less expensive Rear-Wheel Drive option. This shift marks a significant departure from Tesla’s original goal of providing a budget-friendly electric truck to attract a larger range of consumers.

Previously, the Cybertruck was presented with a lower base price, making it an easier choice for buyers. Now, the dual-motor model is priced the same as the base model, further limiting the options for consumers seeking a functional electric truck without excessive cost.

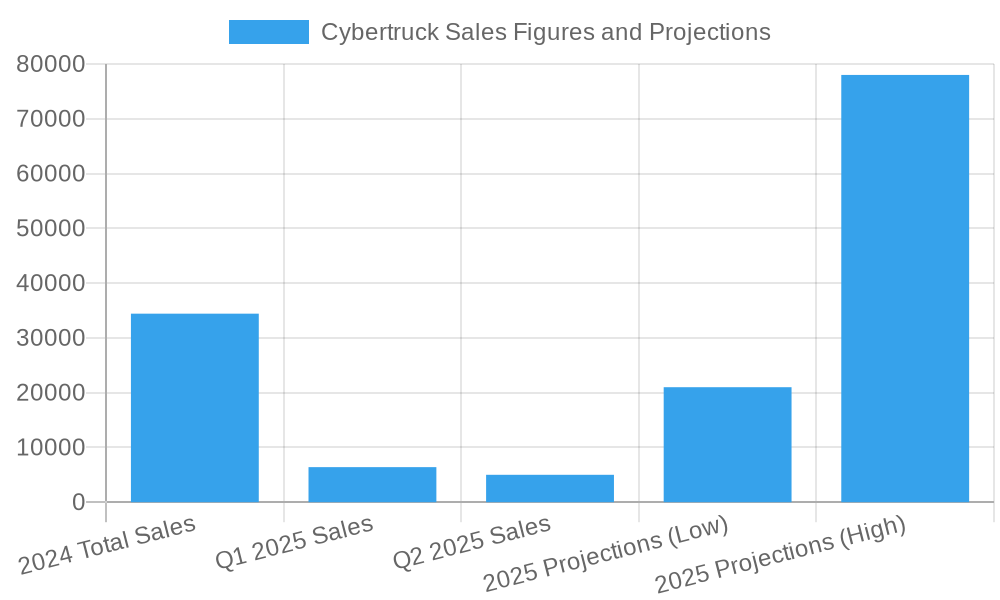

Reports have shown disappointing sales for the Cybertruck, with only 4,306 units sold in the second quarter of 2025. This sales figure is far lower than the expected annual target of 250,000 units. Industry analyst Troy Teslike predicts that Tesla will sell only 21,000 Cybertrucks in 2025, drastically below the earlier figure of 65,000 expected by Wall Street. This decline in projected sales stems from several issues like higher prices, production difficulties, and increasing competition in the electric truck market.

The broader sales performance of Tesla emphasizes these challenges. The Model Y continues to be the best-selling electric vehicle in the U.S., despite a 33.8% drop compared to last year. Meanwhile, the Cybertruck’s struggles become more evident when compared to the Model 3, which saw a 70.3% increase in sales during the same time frame.

Market observers have commented on the effects of this new pricing strategy, with one analyst noting, “It hasn’t been the monumental seller Tesla had hoped…and now it’s just more expensive off the bat.” This perspective highlights the potential risk of losing out on budget-conscious customers who were previously interested in a more affordable model.

Given these developments, Tesla faces a challenging path as it attempts to position the Cybertruck as a premium electric vehicle while ensuring it remains competitive in a quickly evolving market. The future of the Cybertruck will largely hinge on Tesla’s ability to adapt its strategies amid rising challenges and shifting consumer expectations.

Market Reaction and References

The recent alterations to the Tesla Cybertruck’s pricing strategy, particularly the abolition of its base Rear-Wheel Drive option and the establishment of an entry price exceeding $82,000, have led to a notable shift in consumer sentiment and market dynamics. Here’s a synthesis of the major findings regarding this shift:

Consumer Sentiment and Sales Impact

Many potential buyers have expressed disappointment at the sudden price hike, which has significantly affected interest in the vehicle. In the second quarter of 2025, Tesla recorded just 4,306 Cybertruck sales, marking a 51% drop compared to the same quarter the previous year. This slump has been attributed to the new pricing structure, alongside the vehicle’s unconventional aesthetics, which some consumers find off-putting. Many have voiced concerns about the vehicle’s design as well as quality issues, as evidenced by multiple recalls since the launch in November 2023. The recall of 46,000 units due to detaching stainless steel exterior panels further undermined consumer confidence and sales potential.

For further exploration of this topic, you can refer to the report on Tesla’s changing market dynamics and a comparison of Electric Truck Performance.

Competitive Landscape

The Cybertruck is concurrently facing intense competition from other electric pickup trucks that are considerably cheaper. Competitors such as the Ford F-150 Lightning and the GMC Hummer EV have recently outsold the Cybertruck; for instance, GMC reported selling 4,508 Hummer EVs in the same quarter, thereby placing additional pressure on Tesla’s market share. This decline in sales numbers not only reflects a reactive consumer market but indicates shifting sands within the electric truck segment, as buyers gravitate to alternative options that provide better value for their investments.

To better understand the challenges faced by various electric pickups in current market scenarios, see the piece on Ford’s Sales and Production Adjustments.

Tesla’s strategy of raising prices on premium Cybertruck variants, like the Cyberbeast while applying discounts on older inventory points to ongoing struggles to maintain market interest amidst rising operational challenges. Analysts now predict that Tesla may only sell approximately 21,000 Cybertrucks in 2025, significantly lower than previously optimistic projections.

These references and assessments reflect the ongoing trends and competitive pressures within the electric truck market as manufacturers adjust their strategies to meet diverse consumer needs and price sensitivities.

Sales Figures and Market Impact

The sales performance of the Tesla Cybertruck has provoked concerns about its market positioning and profitability. In 2024, the Cybertruck achieved a total of 24,000 units sold; however, the most recent figures reveal a disappointing 15,000 units sold in the first half of 2025 alone. This stark contrast highlights a troubling decline in demand, raising questions about the effectiveness of Tesla’s pricing strategy and overall market appeal.

Decline in Demand

The significant drop in sales signifies a potential shift in consumer interest. The Cybertruck, which was initially lauded for its groundbreaking design and technological advancements, now seems to struggle against heightened competition and evolving market preferences. As consumers weigh the appeal of other electric trucks, notably the Ford F-150 Lightning and the GMC Hummer EV, it appears that buyers may be gravitating toward more affordable and accessible options in the electric pickup segment. In fact, in Q2 of 2025 alone, competitors like Ford reported outselling the Cybertruck, further indicating a seismic shift in market dynamics.

Pricing Strategy Impact

The relationship between sales figures and Tesla’s new pricing strategy cannot be overlooked. The discontinuation of the entry-level Rear-Wheel Drive variant and the elevation of entry prices to over $82,235 may alienate potential customers who were looking for a more budget-friendly electric truck. While the higher price points do align with Tesla’s attempts to position the Cybertruck as a premium product, the reality is that this strategy might inadvertently dissuade new buyers, especially those who previously considered the Cybertruck as an affordable alternative.

Analysts note that the exuberance that surrounded the Cybertruck’s launch has been dampened by the reality of its pricing and lack of features that resonate with the value-conscious consumer. Additionally, the recent recall of over 46,000 units due to defects has further tarnished the brand’s image and dented consumer confidence. These factors collectively suggest that Tesla may need to reevaluate its pricing structure and marketing strategies in order to regain traction and capitalize on consumer interest.

The future trajectory of the Cybertruck is uncertain, especially if sales continue to trend downward. As the electric vehicle market grows increasingly competitive, Tesla must navigate the delicate balance between maintaining its aspirational pricing and ensuring accessibility for a wider audience. Adjustments to the Cybertruck’s consumer strategies in the forthcoming quarters may prove imperative to its resurgence in the marketplace.

Sales Figures and Market Impact

The sales performance of the Tesla Cybertruck has provoked concerns about its market positioning and profitability. In 2024, the Cybertruck achieved a total of 24,000 units sold; however, the most recent figures reveal a disappointing 15,000 units sold in the first half of 2025 alone. This stark contrast highlights a troubling decline in demand, raising questions about the effectiveness of Tesla’s pricing strategy and overall market appeal.

Decline in Demand

The significant drop in sales signifies a potential shift in consumer interest. The Cybertruck, which was initially lauded for its groundbreaking design and technological advancements, now seems to struggle against heightened competition and evolving market preferences. As consumers weigh the appeal of other electric trucks, notably the Ford F-150 Lightning and the GMC Hummer EV, it appears that buyers may be gravitating toward more affordable and accessible options in the electric pickup segment. In fact, in Q2 of 2025 alone, competitors like Ford reported outselling the Cybertruck, further indicating a seismic shift in market dynamics.

Pricing Strategy Impact

The relationship between sales figures and Tesla’s new pricing strategy cannot be overlooked. The discontinuation of the entry-level Rear-Wheel Drive variant and the elevation of entry prices to over $82,235 may alienate potential customers who were looking for a more budget-friendly electric truck. While the higher price points do align with Tesla’s attempts to position the Cybertruck as a premium product, the reality is that this strategy might inadvertently dissuade new buyers, especially those who previously considered the Cybertruck as an affordable alternative.

Analysts note that the exuberance that surrounded the Cybertruck’s launch has been dampened by the reality of its pricing and lack of features that resonate with the value-conscious consumer. Additionally, the recent recall of over 46,000 units due to defects has further tarnished the brand’s image and dented consumer confidence. These factors collectively suggest that Tesla may need to reevaluate its pricing structure and marketing strategies in order to regain traction and capitalize on consumer interest.

The future trajectory of the Cybertruck is uncertain, especially if sales continue to trend downward. As the electric vehicle market grows increasingly competitive, Tesla must navigate the delicate balance between maintaining its aspirational pricing and ensuring accessibility for a wider audience. Adjustments to the Cybertruck’s consumer strategies in the forthcoming quarters may prove imperative to its resurgence in the marketplace.

This chart visually represents the sales trends of the Tesla Cybertruck over the past two years, highlighting a significant decline in sales and projections based on current pricing strategies.

Consumer Reactions and Expectations for the Cybertruck

The Tesla Cybertruck, once held with high expectations, has recently encountered a wave of skepticism and discontent among potential buyers. With Tesla discontinuing its least expensive model and raising the entry-level price to $82,235, consumer reactions reflect a blend of disappointment and cautious interest. An analysis of consumer surveys and reviews reveals critical insights into how pricing changes have impacted perceptions of the Cybertruck’s value in the competitive electric truck market.

Insights into Consumer Sentiment

As of September 2025, consumer reviews for the Cybertruck have shown mixed emotions. Sites like Kelley Blue Book report an average rating of 4.3 out of 5 stars, with positive feedback largely centered around the vehicle’s performance and reliability. However, concerns about value and affordability loom large, especially with rising prices. Although approximately 83% of owners recommend the vehicle, they frequently cite dissatisfaction with the overall pricing strategy and the perception of the Cybertruck as a luxury electric truck.

Further complicating the consumer landscape, a recent survey indicated that 60% of potential buyers now perceive the Cybertruck as a luxury vehicle, steering clear due to the elevated price point. This shift in perception has led to dwindling enthusiasm among budget-conscious buyers who previously viewed the Cybertruck as a competitive, cost-friendly alternative in the electric truck market.

Sales Trends and Market Analyst Perspectives

In light of the recent price adjustments, Tesla’s sales performance has suffered. In Q2 2025, Cybertruck sales plummeted to 4,306 units, marking a staggering 50.8% decline from the previous year. Analysts attribute this downturn to not only increased pricing but also quality control issues that have marred consumer trust. Reports of 46,000 unit recalls, alongside minor defects, have exacerbated these concerns.

Market analysts express growing apprehension regarding the Cybertruck’s future, identifying increasing competition in EV trucks as a key factor in the downturn. In discussions, they highlight that the vehicle’s high price might ultimately alienate a significant portion of its intended market. Some analysts have gone so far as to label the Cybertruck a “strategic miscalculation,” highlighting the dangerous mismatch between consumer expectations and Tesla’s pricing strategy.

In summary, while the Cybertruck generates interest and enthusiasm, the recent price hikes and negative reviews have created a challenging marketing environment. As Tesla addresses these obstacles, it must navigate carefully to keep the Cybertruck desirable while also appealing to a broader audience that values both innovation and affordability.

Conclusion

In summary, Tesla’s recent pricing strategy for the Cybertruck has significantly altered its market stance, moving the entry-level price to $82,235 with the elimination of the base Rear-Wheel Drive model. This change raises critical concerns regarding accessibility, as budget-conscious consumers who once viewed the Cybertruck as a viable option may now find it out of reach. The immediate market reaction indicates a decline in demand, with sales plummeting to just 4,306 units in Q2 2025, a stark contrast to prior expectations.

The notion of the Cybertruck as a premium electric vehicle is juxtaposed with the reality of increased competition from more affordable alternatives, such as the Ford F-150 Lightning and GMC Hummer EV, which have successfully captured consumer interest and sales. Analysts now predict a much lower sales target for the Cybertruck than initially anticipated, forecasting only 21,000 units for the year as buyers turn toward competing models that offer better value.

Moreover, consumer sentiment reflects a growing perception of the Cybertruck as a luxury vehicle, which further alienates a segment of the market that is inclined toward more budget-friendly electric trucks. Given the implications of these pricing adjustments, Tesla must reassess its strategy moving forward. The combination of recent recalls and negative consumer feedback underscores the need for Tesla to regain consumer confidence, suggesting that future pricing strategies may need to be revisited.

Ultimately, the future of the Cybertruck will hinge on Tesla’s ability to balance premium positioning with market accessibility. As the electric truck landscape continues to evolve, adapting to consumer expectations while maintaining competitive pricing will be crucial in rekindling interest and boosting sales for the Cybertruck in the months to come.

Closing Remarks and Future Outlook

As we look ahead, the future of the Tesla Cybertruck remains a subject of cautious optimism tempered by significant challenges. The recent changes to its pricing strategy, with the elimination of the base Rear-Wheel Drive model and an increased entry-level price of $82,235, have raised serious concerns regarding market accessibility. This shift may alienate many budget-conscious consumers who previously regarded the Cybertruck as an affordable option within the burgeoning electric pickup segment.

Current sales figures tell a sobering story, exemplified by a steep drop to merely 4,306 units sold in the second quarter of 2025. This decline not only signifies a substantial dip in consumer interest but also highlights the pressures exerted by a fiercely competitive market. Rivals like the Ford F-150 Lightning and GMC Hummer EV have made significant strides, offering lower-priced alternatives that have successfully captured consumer attention and preference.

Moreover, Tesla faces potential risks including ongoing quality control issues and recalls that might curtail consumer confidence. Analysts have pointed out that there is an increasing perception of the Cybertruck as a luxury item, which may further deter the very consumers Tesla aims to attract. This perception shift could result in a constrained market segment willing to invest in the Cybertruck, ultimately affecting sales projections.

To navigate these challenges successfully, Tesla must recalibrate its strategies to maintain a delicate balance between premium positioning and broader market accessibility. Addressing current consumer sentiment while offering clearer value propositions is crucial to rekindling interest and sales moving forward. As Tesla strives to solidify its vision of an innovative and disruptive electric truck, it must remain vigilant about evolving customer expectations and competitive pressures to secure a lasting foothold in this dynamic market.

In conclusion, while the Cybertruck holds the promise of revolutionizing the electric truck segment, it is clear that maintaining consumer trust and interest amidst changing perceptions and stiff competition will be paramount for Tesla’s success in the months ahead.